does california have estate or inheritance tax

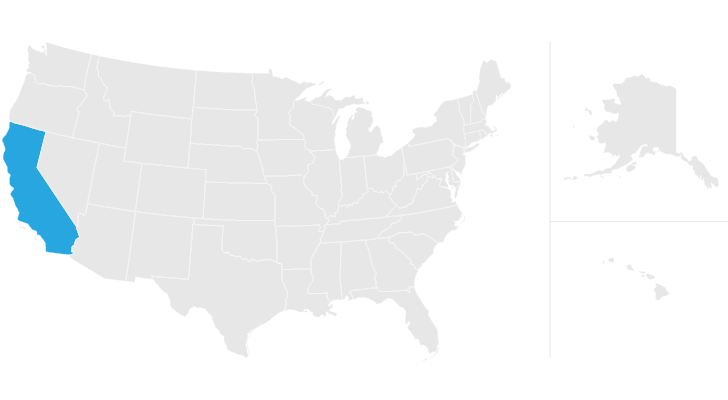

However California is not among them. However the estate still has to file tax returns.

Estate Inheritance Taxes In Texas Vs California

However this doesnt mean that inheritance taxes cant affect California residents who leave assets to individuals in other states.

. The estate must file for an EIN before filing any tax returns. That this does not necessarily mean that your inheritance will be tax-free. Maryland is the only state to impose both now that New Jersey has repealed its estate tax.

Does California Impose an Inheritance Tax. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

California inheritance laws especially when there isnt a valid will in place can get a bit convoluted. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. A state inheritance tax was enacted in colorado in 1927.

As of right now only six taxes require an inheritance tax on people who inherit money. Estate tax of 08 percent to 16 percent on estates above 4 million Iowa. Inheritance tax of up to 15 percent.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The state of California does not impose an inheritance tax. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents.

Like the majority of states there is no inheritance tax in California. As of 2021 12 states plus the District of Columbia impose an estate tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual. Colorado does not have an inheritance tax or estate tax. While California does not have an inheritance tax the state does have some special tax-related issues that affect beneficiaries.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The California Inheritance Tax and Gift Tax As I previously mentioned there is no inheritance tax in California regardless of net worth. Estate tax of 112 percent to 16 percent on estates above 4 million Hawaii.

How is Inheritance Tax Calculated. Keep reading as Financial Planner LA explains what you need to know about inheritances and estate taxes in California. But the good news is that California does not assess an inheritance tax against its residents.

If you are a beneficiary you will not have to pay tax on your inheritance. People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation. There are a few exceptions such as the Federal estate tax.

You would receive 950000. There are only 6 states in the country that actually impose an inheritance tax. That being said California does not have an inheritance tax.

Until 2005 a tax credit was allowed for federal estate. California doesnt have state-level estate taxes-the federal estate tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

Lets say you live in Californiawhich does not have an inheritance taxand you inherit from your uncles estate. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance. For decedents that die on or after June 8 1982 and before January 1 2005 a California Estate Tax Return is required to be filed with the State Controllers Office if.

There is also no gift. The Benicia Middle School Color Guard. He lived in Kentucky at the time of his death.

Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount. There are no estate or inheritance taxes in California. They may apply to you and your inheritance.

Generally speaking inheritance is not subject to tax in California. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent.

When assets are left to someone who lives in a state with an inheritance tax he or she will be liable despite the fact that the decedents estate is located in California. Thats why planning out your estate ahead of time is of paramount concern. Just five states apply an inheritance tax.

Like most US. You would owe Kentucky a tax on your inheritance because Kentucky is one of the six states that collect a state inheritance tax. As stated above California does not impose taxes on estates or inheritances.

You would pay 95000 10 in inheritance taxes. This is huge for my California financial-planning clients. For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return.

The estate would pay 50000 5 in estate taxes. Only 14 States impose estate taxes. California is part of the 38 states that dont impose their own estate tax on inheritances.

After you die your representative will pay this tax out of your estate before assets are distributed to beneficiaries. If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual. The District of Columbia moved in the.

If you are getting money from a relative who lived in another state though make sure you check out that states laws. However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US. Kentucky for instance has an inheritance tax that may apply if you inherit property located in the state.

Estate tax of 108 percent to 12 percent on estates above 71 million District of Columbia. Proposition 19 was approved by California voters in the November 2020 election and will result in significant changes to the property tax benefits Californians enjoyed previously under the 1978 Proposition 13 law in effect previously. In California there is no state-level estate or inheritance tax.

EIN Employer Identification Number. Estate tax of 10 percent to 20 percent on estates above 55 million Illinois. Washington has been at the top for a while but Hawaii raised.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is There A California Estate Tax In California Pasadena Estate Planning

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp

California S Tax On Inherited Properties Hurts Minority Communities Calmatters

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Property Tax Inheritance Exclusion

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

How Much Is Inheritance Tax Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Is Inheritance Taxable In California California Trust Estate Probate Litigation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die